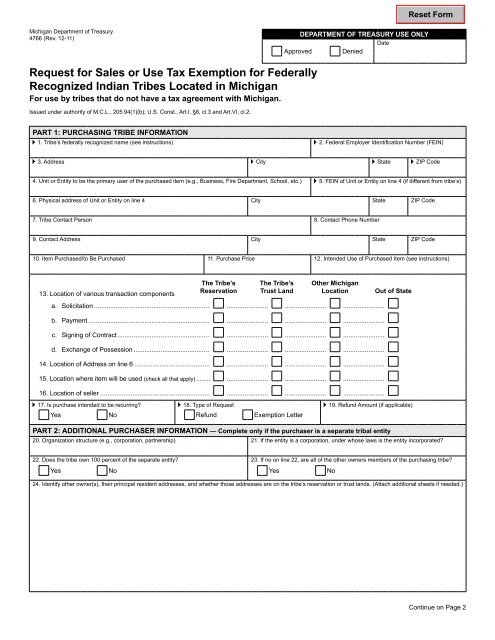

michigan use tax exemptions

Use tax is also. MDEQ 3243601 allows certain farmland owners in Michigan to enroll in a development rights.

What Transactions Are Subject To The Michigan Use Tax Kershaw Vititoe Jedinak Plc

The People of the State of Michigan enact.

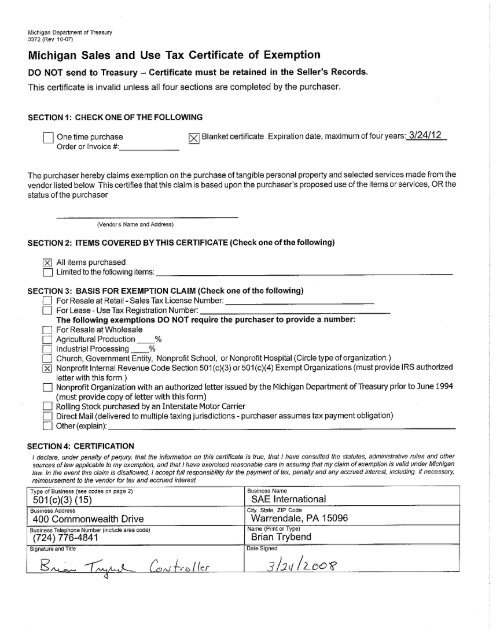

. This act may be cited as the Use Tax Act. Instructions for completing Michigan Sales and Use Tax Certicate of Exemption Form 3372 Purchasers may use this form to claim exemption from Michigan sales and use tax on qualied. See Use Tax below for examples of transactions that may be subject to use.

The certificate that qualifying agricultural producers organizations and other exempt entities may use is the Michigan Sales and Use Tax Certificate of Exemption or form. The Michigan use tax should be paid for items bought tax-free over the internet bought while traveling or transported into Michigan from a state with a lower sales tax rate. The Michigan use tax is a special excise tax assessed on property purchased for use in Michigan in.

Sales and Use Tax Exemption for Qualifying Manufacturing Machinery and Equipment Clarified REV 27 0021 102819 To ask about the availability of this publication in. Apply for or renew license. Use tax of 6 percent must be paid on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases by mail from out-of-state retailers.

The University of Michigan as an instrumentality of the State of Michigan is exempt from the payment of sales and use taxes on purchases of tangible property and applicable. Do Business with the City. Department of Treasury holding that the Michigan Use Tax apportionment rules apply in situations where property is simultaneously used for exempt and non-exempt.

Are Farms Tax Exempt In Michigan. A sales tax exemption certificate can be used by businesses or in some cases individuals who are making purchases that are exempt from the Michigan sales tax. In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

Several examples of exemptions to the states sales tax are vehicles. Thursday June 10 2021 On June 8 the Michigan legislature in an overwhelming bipartisan vote passed two bills providing for exemptions from the states sales and use tax. 20591 Use tax act.

Find or apply for employment. There are no local sales taxes in the state of Michigan. The state of Michigan levies a 6 state sales tax on the retail sale lease or rental of most goods and some services.

History1937 Act 94 Eff. You can download a PDF. Apply for or renew permit or certification.

The University of Michigan as an instrumentality of the State of Michigan generally is exempt from payment of Michigan sales and use tax on purchases of tangible property and rentals.

Michigan Veterans Property Tax Exemption Form 5107 Fill Out Sign Online Dochub

Exemption For Michigan Data Centers January 2016 Avalara

Revenue Administrative Bulletin 1995 3 State Of Michigan

Michigan Sales Tax Handbook 2022

Michigan Vehicle Sales Tax Fees Calculator Find The Best Car Price

Out Of State Homeowners Use Loophole To Avoid Michigan Property Taxes Mlive Com

Michigan Data Center Sales And Use Tax Exemption Walton

Age 65 And Over Tax Exemptions For Michigan Agexmmi26a647ncen Fred St Louis Fed

Michigan Sales And Use Tax Certificate Of Exemption Students Sae

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Pet Food Could Become Exempt From Sales Tax In Michigan Wzzm13 Com

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Sales And Use Tax Exemption For Ppe Uhy

Michigan Unclaimed Use Tax Exemption Refund Simekscott

Michigan Sales Tax And Use Tax Exemption Certificate Form Fibers Of Kalamazoo

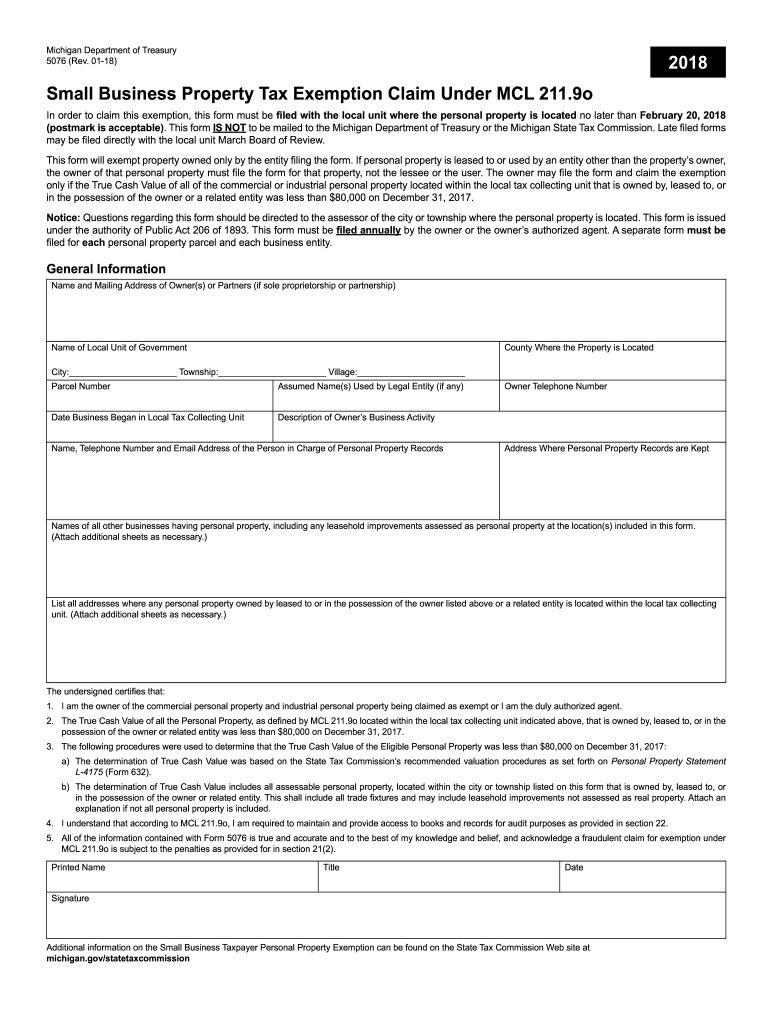

Small Business Property Tax Exemption Claim Under Mcl 211 Fill Out Sign Online Dochub

Michigan Certificate Of Tax Exemption From 3372 Fill Out Sign Online Dochub